Latest dividend announcement

Comfort Systems USA, Inc. (NYSE: FIX) raised its quarterly dividend to $0.70 per share. The new distribution reflects a 16.7% increase from the previous quarterly dividend of $0.60. The board approved the higher payout following a record fourth quarter and strong full-year 2025 results. The decision signals management’s confidence in earnings durability and cash flow generation.

Details of the dividend distribution

The dividend is payable on March 17, 2026. Shareholders of record as of early March 2026 will receive the payment. Based on the new quarterly rate of $0.70, the annualized dividend rises to $2.80 per share, up from a 2025 run rate of $2.40 implied by the last $0.60 quarterly payment.

At a recent share price of approximately $1,420, the forward dividend yield stands near 0.2%. The payout ratio remains conservative. Based on trailing earnings per share of $23.62, the dividend consumes roughly 12% of net income. On a forward EPS estimate of $36.26, the payout ratio declines to below 8%. This low distribution burden leaves ample headroom for reinvestment, acquisitions, and additional dividend growth.

Relevant valuation metrics

Comfort Systems commands a market capitalization of about $50.1 billion. The stock trades at a trailing price-to-earnings ratio of roughly 60 and a forward P/E of about 39. The forward multiple reflects strong expected earnings expansion. Analysts project robust profit growth, supported by revenue growth of more than 35% year over year and quarterly earnings growth near 100%.

Enterprise value totals approximately $47.9 billion, which implies an enterprise value-to-EBITDA multiple of about 38. EBITDA margins stand near 15%. Free cash flow recently reached more than $600 million on a trailing basis, while total revenue exceeds $8.3 billion. The balance sheet shows moderate leverage, with total debt of roughly $424 million and total cash of about $881 million. This net cash position enhances financial flexibility and reduces refinancing risk.

For dividend investors, the combination of high earnings growth, expanding margins, and strong free cash flow conversion supports sustained distribution increases, even at a low initial yield.

Dividend history and sustainability

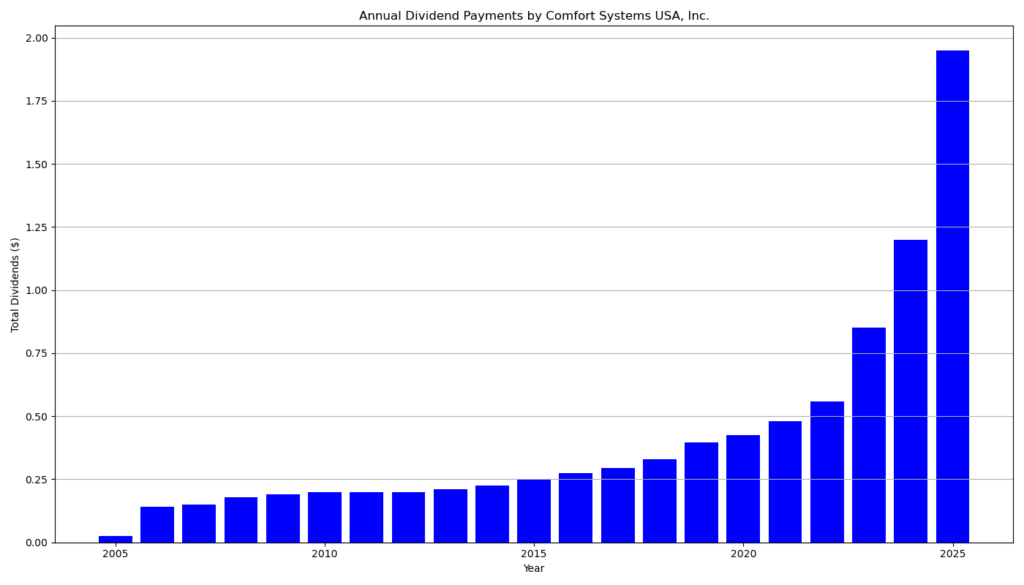

Comfort Systems has paid uninterrupted dividends for 20 consecutive years and has increased its dividend for 13 consecutive years. The historical payment record shows a gradual but consistent step-up pattern. The quarterly dividend stood at $0.10 in 2019. It rose to $0.25 by late 2023, advanced to $0.35 in late 2024, and reached $0.60 in November 2025. The newly declared $0.70 marks another material increase.

The multi-year acceleration in dividend growth aligns with the company’s expanding earnings base. In 2025 alone, earnings per share surged, and operating cash flow exceeded $1.0 billion. The current payout ratio remains low relative to both net income and free cash flow. This conservative capital allocation framework enhances sustainability, even in cyclical downturns within the engineering and construction sector.

Outlook for long-term investors

Comfort Systems operates in a cyclical industry with exposure to commercial construction, industrial projects, and institutional demand. The stock exhibits a beta of roughly 1.67, which indicates above-average volatility. Investors must therefore tolerate price fluctuations.

However, structural demand drivers such as data center construction, manufacturing reshoring, energy infrastructure, and institutional retrofits support long-term growth. A substantial project backlog underpins revenue visibility. Strong margins and disciplined cost control improve operating leverage.

Given the modest payout ratio, management can continue double-digit dividend growth if earnings expand as projected. The current yield remains low, but the growth trajectory appeals to investors who prioritize dividend compounding over immediate income.

A brief company profile

Comfort Systems USA, Inc. operates in the Industrials sector within the Engineering & Construction industry. The company provides heating, ventilation, air conditioning, and electrical contracting services to commercial, industrial, and institutional clients. It maintains 190 locations across 142 U.S. cities. Its integrated service model, decentralized operating structure, and acquisition strategy have driven scale, margin expansion, and consistent shareholder returns.

last quarterly report*

Comfort Systems USA reported record fourth quarter and full-year 2025 results, driven by strong demand and expanding backlog .

For the fourth quarter of 2025, revenue rose to $2.65 billion, up from $1.87 billion in the prior-year period. Net income more than doubled to $330.8 million, or $9.37 per diluted share, compared with $145.9 million, or $4.09 per diluted share, in the fourth quarter of 2024. Operating income increased to $426.7 million, representing a margin of 16.1%, versus 12.1% a year earlier. Gross margin improved to 25.5% from 23.2%, reflecting operating leverage and execution discipline.

For the full year 2025, revenue reached $9.10 billion, up from $7.03 billion in 2024. Net income climbed to $1.02 billion, or $28.88 per diluted share, compared with $522.4 million, or $14.60 per diluted share, in the prior year. Operating income rose to $1.31 billion, with operating margin expanding to 14.4% from 10.7%. Adjusted EBITDA for 2025 totaled $1.45 billion, up from $891.8 million in 2024, with margin expansion to 16.0% .

Cash generation was strong. Operating cash flow reached $468.5 million in the fourth quarter and $1.19 billion for the full year, compared with $210.5 million and $849.1 million, respectively, in 2024. Free cash flow totaled $403.0 million in the quarter and $1.04 billion for the year, up from $171.7 million and $743.5 million in the prior-year periods . This robust cash conversion strengthens financial flexibility.

Backlog reached $11.94 billion at year-end 2025, compared with $5.99 billion at the end of 2024. On a same-store basis, backlog grew to $11.58 billion, nearly doubling year over year . This substantial backlog provides strong revenue visibility for 2026.

The balance sheet improved materially. Cash and cash equivalents increased to $981.9 million from $549.9 million at year-end 2024. Total assets rose to $6.44 billion. Long-term debt stood at $139.1 million, up from $62.3 million, but leverage remains modest relative to earnings and cash flow. Stockholders’ equity increased to $2.45 billion .

Dividends per share for 2025 totaled $1.95, up from $1.20 in 2024. In the fourth quarter, the company paid $0.60 per share, compared with $0.35 in the prior-year quarter . The higher earnings base and strong free cash flow support dividend growth and capital returns.

Management highlighted persistent demand, strong pipelines, and confidence in 2026 prospects. However, the company also outlined risks, including labor shortages, cost inflation, supply chain disruptions, and potential backlog conversion volatility.

Overall, Comfort Systems USA delivered exceptional top-line growth, significant margin expansion, record earnings, and strong cash generation in 2025. The nearly doubled backlog and strengthened balance sheet position the company well for continued growth, though execution risks in a cyclical construction environment remain relevant.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?