Latest dividend announcement

Martin Marietta Materials declared a regular quarterly cash dividend of $0.83 per share. The board kept the payout in line with the prior quarter, so income investors see continuity rather than a step-up.

Details of the dividend distribution

The company will pay the dividend on March 31, 2026. Shareholders must own shares by the March 2, 2026 record date to receive the payment. The shares trade ex-dividend on March 2, 2026, which aligns with the record-date convention for U.S. equities. At the current share price provided, the indicated annual dividend rate of about $3.32 per share implies a forward yield near 0.5%. That yield sits well below typical “high-yield” screens, so the thesis relies more on dividend growth and capital compounding than on immediate income.

Relevant valuation metrics

The stock trades around $675 per share with a market capitalization near $40.7 billion. Enterprise value stands near $46.0 billion, which places the EV/EBITDA multiple around 22x on the provided EBITDA figure of roughly $2.1 billion. The forward P/E sits near 29x based on forward EPS around $23.26, while the trailing P/E runs above 34x on trailing EPS near $19.86.

The balance sheet carries about $5.3 billion of total debt and only modest cash of roughly $0.1 billion. That leverage looks manageable for a scaled aggregates platform, but it still raises the hurdle for aggressive dividend acceleration if rates stay restrictive.

Dividend history and sustainability

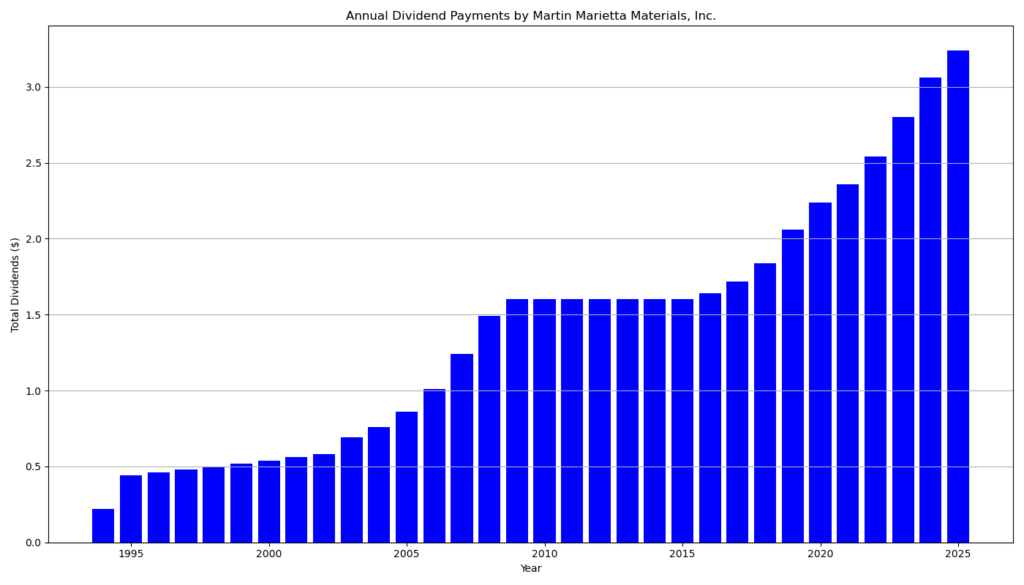

Martin Marietta has paid dividends for 31 consecutive years and has grown the payout for 10 consecutive years. The recent pattern shows a long flat stretch at $0.40 through 2016, then a steady step-up cadence. The company last raised the quarterly dividend from $0.79 to $0.83 in 2025, a lift of about 5%. The new declaration simply extends that level.

Sustainability looks strong on earnings coverage. The payout ratio stands around 16%, which gives management wide flexibility. The key question centers on cash conversion. One dataset shows negative free cash flow, yet the company reported operating cash flow near $1.8 billion in 2025 and capital expenditures near $0.8 billion, which implies positive “capex-style” free cash flow close to $1.0 billion. The gap likely reflects different free-cash-flow definitions, working-capital timing, and acquisition spending. Dividend investors should focus on recurring operating cash flow, maintenance capital intensity, and cycle-adjusted margins rather than on any single headline free-cash-flow figure.

Outlook for long-term investors

Management guided 2026 revenue around $6.6 billion at the midpoint and adjusted EBITDA from continuing operations around $2.2 billion. The guide assumes low-single-digit shipment growth and mid-single-digit pricing. That mix matters. Aggregates economics reward pricing discipline, route density, and reserve position. Those factors can protect margins even when volumes soften.

Still, investors should stress-test a downturn. Aggregates demand tracks infrastructure, nonresidential activity, and housing. A prolonged construction slowdown can pressure volumes and absorb fixed costs. Martin Marietta offsets that risk with pricing power, a broad footprint, and a comparatively conservative payout ratio. The current dividend looks durable, but the valuation leaves less room for execution missteps.

A brief company profile

Martin Marietta Materials is a U.S.-based supplier of aggregates and heavy building materials with operations across 28 states, plus Canada and The Bahamas. The company also runs a Specialties segment that sells high-purity magnesia and dolomitic lime into environmental, industrial, agricultural, and specialty end markets. That portfolio blends infrastructure-linked ballast with niche, higher-value specialty products, which supports resilient cash generation and long-run dividend capacity.

last quarterly report*

Martin Marietta reported solid top-line growth and record profitability in its core aggregates segment for the fourth quarter and full year 2025.

According to the earnings release on page 1, fourth-quarter revenues rose 9% to $1.53 billion, while full-year revenues increased 9% to $6.15 billion . Gross profit grew 10% in the quarter to $468 million and 16% for the year to $1.89 billion, reflecting margin expansion in the aggregates business.

However, net earnings declined significantly year over year. Full-year net earnings from continuing operations attributable to Martin Marietta fell 45% to $990 million, and diluted EPS from continuing operations dropped to $16.34 from $29.50 in 2024 . The prior year included a large nonrecurring divestiture gain, which distorts comparability.

Operationally, aggregates remained the key profit driver. Fourth-quarter shipments increased 2% to 48.9 million tons, while the average selling price rose 5% to $23.11 per ton . Gross profit per ton improved 9% to $8.59, and full-year aggregates gross margin reached 34%, up from 32% in 2024 . This pricing power and margin expansion highlight strong execution despite softer residential construction.

Cash generation strengthened. Net cash provided by operating activities increased 22% to a record $1.79 billion in 2025 . The company invested $807 million in capital expenditures and spent $685 million on acquisitions. It returned $647 million to shareholders through dividends and share repurchases .

The balance sheet remains stable. As of December 31, 2025, long-term debt stood at $5.29 billion, while total equity reached $10.03 billion . Cash on hand declined to $67 million, reflecting acquisitions and capital allocation activity.

For 2026, management guides for revenues between $6.42 billion and $6.78 billion, with adjusted EBITDA from continuing operations projected at $2.16 billion to $2.31 billion . Aggregates volumes are expected to grow 1% to 3%, with pricing up 4% to 6%, suggesting continued margin resilience.

In summary, Martin Marietta delivered record aggregates profitability and strong cash flow in 2025. While headline earnings declined due to prior-year divestiture gains, the underlying operating performance improved. The company enters 2026 with disciplined pricing, solid infrastructure demand, and a healthy balance sheet.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?