Latest Dividend Announcement

The board of directors of AbbVie Inc. declared a regular quarterly cash dividend of $1.73 per share. This current distribution strictly matches the previous quarter’s payout. The management team maintains a steadfast commitment to returning substantial capital to its shareholders through reliable distributions.

Details of the Dividend Distribution

The company will distribute this cash dividend on May 15, 2026. Stockholders of record at the close of business on April 15, 2026, will successfully receive the payment in their accounts. The ex-dividend date falls on that exact same day, April 15, 2026. This ongoing quarterly distribution generates a lucrative annualized dividend rate of $6.92 per share.

Relevant Valuation Metrics

AbbVie currently trades at an attractive forward price-to-earnings ratio of 13.99. The stock offers a compelling forward dividend yield of approximately 3.04 percent based on recent market prices. The enterprise holds a massive market capitalization of $397.33 billion. For the full fiscal year 2025, AbbVie generated $61.16 billion in total revenue. Core operations produced $19.03 billion in operating cash flow. After subtracting $1.21 billion in capital expenditures, the company generated $17.82 billion in total free cash flow. This robust free cash flow metric easily covers all annual dividend obligations. The firm manages a total debt load of $68.85 billion against total cash reserves of $5.67 billion. The adjusted earnings per share reached $10.00 in 2025, which clearly demonstrates strong underlying corporate profitability.

Dividend History and Sustainability

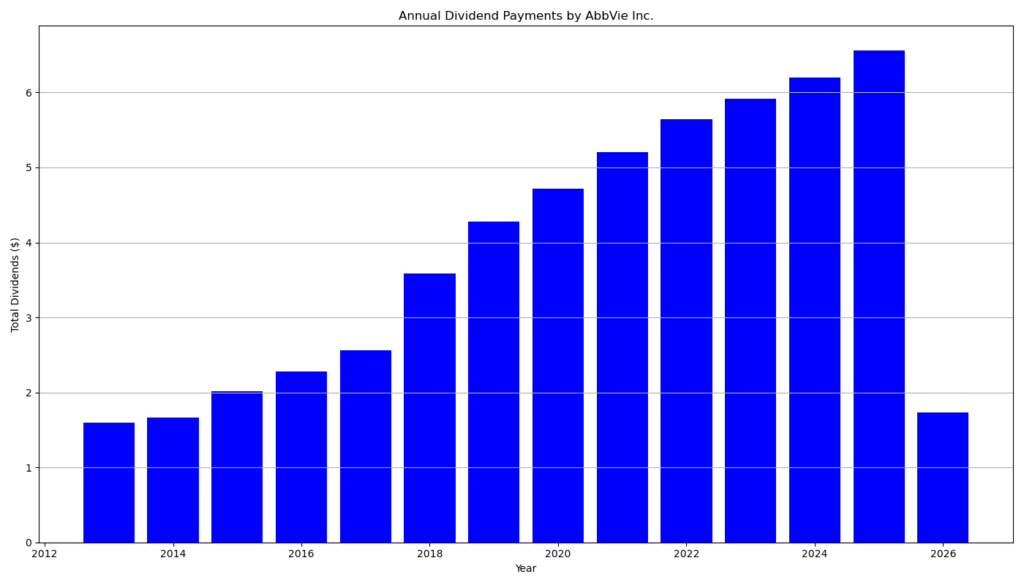

AbbVie boasts 12 consecutive years of steady dividend growth and uninterrupted shareholder payments. The company proudly qualifies as a member of the prestigious S&P Dividend Aristocrats Index. Since its independent inception in 2013, the pharmaceutical giant has grown its dividend by more than 330 percent. The quarterly payout started at just $0.40 per share in 2013 and now confidently stands at $1.73 per share. The executive board recently enacted a 5.5 percent dividend hike in October 2025, moving the payout from the prior $1.64 level to the current $1.73 amount. The company distributed exactly $11.66 billion in total cash dividends during 2025. The massive free cash flow generation yields a highly sustainable cash dividend payout ratio of roughly 65 percent. This moderate payout ratio ensures maximum dividend safety and preserves ample room for future distribution hikes.

Outlook for Long-Term Investors

Long-term income investors rely heavily on AbbVie for steady cash flow and inflation-beating dividend growth. The company successfully navigates the patent expiration phase of its legacy blockbuster drug Humira. Newer immunology pipeline drugs Skyrizi and Rinvoq drive substantial revenue expansion and effectively offset legacy sales declines. The robust clinical product pipeline and recent strategic biotechnology acquisitions fuel future earnings growth. The highly manageable debt profile and strong investment-grade credit rating actively minimize long-term financial risk. Dividend investors secure an attractive entry yield coupled with highly dependable annual payout expansion.

A Brief Company Profile

AbbVie operates globally as a diversified, research-based biopharmaceutical company. The firm continually discovers and delivers innovative medicines to solve serious human health issues. The company commands dominant market leadership positions across several critical therapeutic areas, including immunology, neuroscience, oncology, and aesthetics. Top commercial products include blockbuster treatments Skyrizi, Rinvoq, Vraylar, and the extensive Allergan Aesthetics portfolio featuring Botox and Juvederm.

last quarterly report*

Based on the provided Q4 and Full-Year 2025 earnings press release and Form 10-K for AbbVie Inc. (ABBV), here is an analysis and interpretation of the key financial metrics, followed by an explanation of why they matter specifically to dividend-focused retail investors.

Key Metrics for AbbVie (Q4 & Full-Year 2025)

1. Revenue

- The Numbers: AbbVie generated

16.62billion∗∗inQ42025(a10.016.62 billion** in Q4 2025 (a 10.0% increase year-over-year) and **16.62billion∗∗inQ42025(a10.061.16 billion for the full year 2025 (an 8.6% increase). - Interpretation: The company is showing robust top-line growth. The primary drivers were its newer immunology drugs, Skyrizi (up 50% to $17.56B) and Rinvoq (up 39% to $8.30B), which are successfully offsetting the steep revenue declines of its legacy blockbuster drug Humira (down 49.5% due to biosimilar competition).

2. Earnings Per Share (EPS)

- The Numbers: Full-year GAAP diluted EPS was $2.36 (down 1.3%), while full-year Adjusted diluted EPS was $10.00 (down 1.2%).

- Interpretation: The large gap between GAAP and Adjusted EPS is primarily due to significant one-time acquisition, integration, and in-process research & development (IPR&D) expenses (e.g., AbbVie’s acquisitions of Cerevel Therapeutics and ImmunoGen). Adjusted EPS provides a clearer picture of the company’s baseline operational profitability, which remains very strong at $10.00 per share.

3. Free Cash Flow (FCF)

- The Numbers: AbbVie generated

19.03billioninOperatingCashFlow∗∗in2025.Afterdeducting∗∗19.03 billion in Operating Cash Flow** in 2025. After deducting **19.03billioninOperatingCashFlow∗∗in2025.Afterdeducting∗∗1.21 billion in Capital Expenditures, AbbVie’s generated roughly $17.82 billion in Free Cash Flow. - Interpretation: AbbVie is a massive cash-generating machine. Despite aggressive investments in R&D and acquisitions, the core business throws off nearly $18 billion in excess cash that can be used to reward shareholders and pay down debt.

4. Debt Profile

- The Numbers: Total debt stands at roughly

67.50billion∗∗(67.50 billion** (67.50billion∗∗(65.0 billion in long-term debt and2.5billioninshort−termborrowings).Cashandequivalentssitat∗∗2.5 billion in short-term borrowings). Cash and equivalents sit at **2.5billioninshort−termborrowings).Cashandequivalentssitat∗∗5.23 billion. - Interpretation: AbbVie carries a substantial debt load, which was recently increased to fund major acquisitions. However, with an investment-grade credit rating (recently upgraded by Moody’s to A2) and nearly $18 billion in annual free cash flow, the debt is highly manageable.

5. Dividend Growth, Payout Ratio, and Yield

- Dividend Growth: In October 2025, AbbVie announced a 5.5% increase to its quarterly dividend, raising it from

1.64to∗∗1.64 to **1.64to∗∗1.73 per share** (payable in February 2026). This translates to an annualized forward dividend of $6.92 per share. - Payout Ratio: Based on the $6.65 in dividends actually paid during 2025 against the $10.00 in Adjusted EPS, the earnings payout ratio is 66.5%. Looking at cash flow, the $11.66 billion paid in cash dividends against the $17.82 billion in Free Cash Flow equates to a cash payout ratio of 65.4%.

- Dividend Yield: While the yield depends on the daily stock price, if we assume a share price of roughly $185 (based on the mid-2025 outstanding share value), the forward yield sits in the very attractive 3.7% range.

Why These Metrics Matter to Dividend Investors

Revenue & Adjusted EPS (The Engine)

Dividend investors need to know that a company’s underlying business is healthy. Without growing revenue and earnings, a company cannot sustain dividend increases over the long term. For AbbVie, the successful growth of Skyrizi and Rinvoq proves that their „engine“ is successfully transitioning past the loss of Humira’s patent exclusivity.

Free Cash Flow (The Source of Truth)

Dividends are paid out of cold, hard cash, not accounting earnings. A company can have positive earnings but negative cash flow. FCF is the ultimate metric for dividend safety. AbbVie’s massive $17.8 billion in FCF shows they can easily afford the $11.6 billion it takes to pay their annual dividend, leaving billions left over to pay down debt or acquire new assets.

Debt Profile (The Hidden Risk)

High debt can be a „dividend killer.“ If a company is over-leveraged, a downturn in the economy or rising interest rates can force management to cut the dividend to satisfy creditors. While AbbVie’s $67.5 billion debt load is high, their strong credit rating and massive cash flow assure investors that the dividend is not in danger of being cut to service debt.

Payout Ratio (The Margin of Safety)

The payout ratio tells an investor how much of a company’s earnings/cash is being eaten up by the dividend. A ratio over 85-90% is a red flag. AbbVie’s ~65% payout ratio sits in the „sweet spot.“ It is high enough to reward shareholders generously, but low enough to leave a comfortable safety buffer if earnings temporarily dip, and provides plenty of room for future dividend hikes.

Dividend Growth (The Inflation Shield)

A static dividend loses purchasing power over time due to inflation. Consistent dividend growth (like AbbVie’s recent 5.5% hike) effectively protects the investor’s purchasing power and continuously increases the „yield on cost“ for long-term holders.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?