Latest dividend announcement

Lincoln Electric’s board declared a quarterly cash dividend of $0.79 per common share. The company kept the payout in line with the prior quarter. That decision confirms management’s preference for steady, repeatable capital returns over abrupt step-ups.

Details of the dividend distribution

Lincoln Electric will pay the dividend on April 15, 2026. Shareholders must own the stock by the record date of March 31, 2026. The shares will trade ex-dividend on March 31, 2026. At the current market price of about $289, the dividend implies a forward yield near 1.09% and an indicated annual dividend rate of roughly $3.16 per share.

Relevant valuation metrics

Lincoln Electric trades at a forward P/E near 24.3 based on forward EPS of about $11.88. The trailing P/E sits near 31.0 on trailing EPS of about $9.33. The equity also screens expensive on balance sheet metrics, with a price-to-book near 10.8 and book value around $26.75 per share.

Enterprise value stands near $16.9 billion. That level translates into an EV/EBITDA around 20.0 on EBITDA of about $0.84 billion. Those multiples price in durable margins and continued execution, which raises the bar for future dividend acceleration.

Dividend history and sustainability

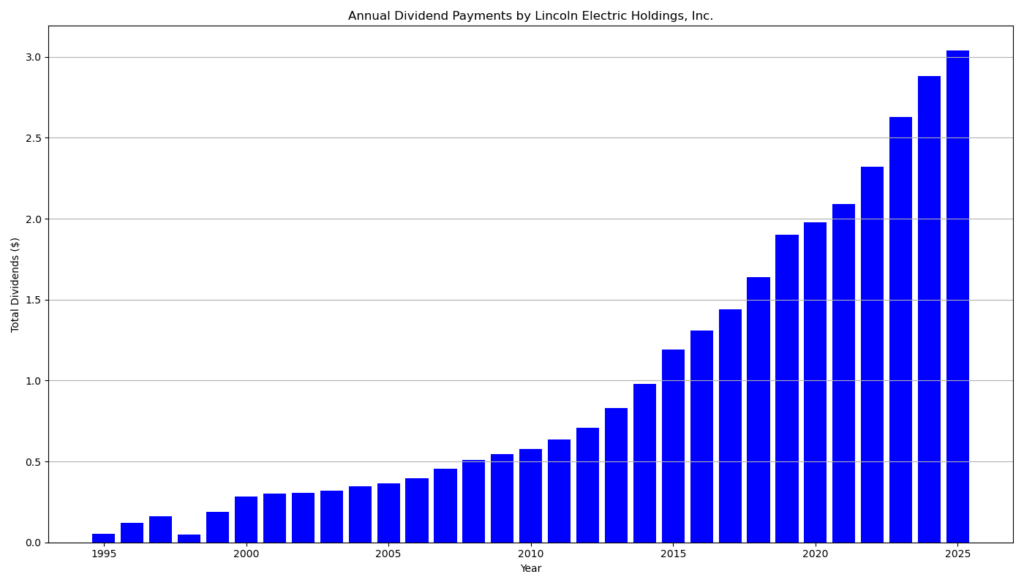

Lincoln Electric has built a strong dividend brand. It shows 27 consecutive years of dividend payments and 27 consecutive years of dividend growth. The recent step pattern matters for context. The quarterly dividend moved from $0.71 through most of 2024 to $0.75 in late 2024, then to $0.79 for the December 2025 payment. The newly declared $0.79 rate extends that level but does not add a new increase.

Coverage looks healthy. Lincoln Electric produced $0.66 billion in operating cash flow in 2025 and about $0.53 billion in free cash flow after capital expenditures. The company paid about $0.17 billion in cash dividends during 2025. That math implies free cash flow covered dividends by roughly 3x, even before considering earnings strength.

The payout ratio also supports sustainability. The ratio sits near 33%, which leaves room for reinvestment, bolt-on M&A, and repurchases. Lincoln Electric returned about $0.51 billion to shareholders in 2025 through dividends and buybacks, so management clearly treats capital returns as a core policy lever.

Balance sheet risk looks manageable. The company held about $0.31 billion in cash at year-end 2025 and carried total debt near $1.29 billion. That leverage level supports dividend stability, but it can constrain aggressive payout growth during cyclical slowdowns.

Outlook for long-term investors

Lincoln Electric operates in industrial end markets that swing with capital spending, fabrication activity, and infrastructure cycles. The company still posted 2025 revenue of about $4.23 billion and maintained strong operating margins. That operating profile supports the dividend.

Dividend investors should stay disciplined on entry price. The yield remains low, and the valuation multiple looks demanding versus many industrial peers. Future total return will likely rely on earnings growth and continued repurchases, not just yield. A high-quality dividend with a modest starting yield can still compound well, but only if the business sustains pricing power and margin discipline.

A brief company profile

Lincoln Electric is an industrial machinery and technology company focused on welding and adjacent workflows. It sells equipment, consumables, and automation solutions across welding, cutting, brazing, machining, process automation, and field repair. The company operates 71 manufacturing and automation facilities across 20 countries and serves customers in more than 160 countries. Its scale, installed base, and application expertise support resilient cash flows that underpin its long-running dividend record.

last quarterly report*

Lincoln Electric reported solid revenue growth and higher full-year profitability in 2025, while maintaining strong cash generation and shareholder returns .

Fourth Quarter 2025

Net sales rose 5.5% year over year to $1.08 billion, driven by 2.5% organic growth, 1.1% from acquisitions, and 1.9% favorable FX. Operating income reached $184.3 million, with a 17.1% margin, slightly below last year’s 17.3%. Adjusted operating margin was 18.0%.

Net income totaled $136.0 million, or $2.45 per diluted share, compared with $2.47 in the prior year. Adjusted EPS increased to $2.65 from $2.57, reflecting operational discipline despite higher tax expense and cost pressures.

Free cash flow for the quarter was $52.0 million. Cash conversion was 35%, down from 44% a year earlier, reflecting working capital movements.

Full Year 2025

For the full year, net sales increased 5.6% to $4.23 billion. Organic sales grew 2.5%, with acquisitions contributing 2.7%. Operating income improved to $718.1 million, lifting the margin to 17.0% from 15.9% in 2024.

Net income rose 11.7% to $520.5 million. Diluted EPS increased 14.4% to $9.32. Adjusted EPS reached $9.87, up from $9.29. The higher earnings reflect improved pricing, productivity, and lower special charges versus the prior year.

Operating cash flow totaled $661.2 million. Free cash flow reached $534.2 million, up from $482.4 million in 2024. Cash conversion improved to 97% from 91%, indicating strong earnings quality and efficient capital management.

Balance Sheet and Capital Allocation

Lincoln Electric ended 2025 with $308.8 million in cash. Total debt stood at $1.29 billion. Total debt-to-invested capital improved to 46.8% from 48.7% in 2024. Return on invested capital was 20.2% (21.3% adjusted), underscoring efficient capital deployment.

The company returned $507 million to shareholders through dividends and share repurchases during the year. Cash dividends paid per share increased to $3.00 from $2.84 in 2024, reflecting continued dividend growth.

Segment Performance

Americas Welding, the largest segment, delivered 6.2% full-year sales growth to $2.72 billion. International Welding remained stable at $930.9 million, while The Harris Products Group grew 13.4% to $578.6 million.

Adjusted EBIT margin at the consolidated level was 17.8% for the year, consistent with 2024, demonstrating margin resilience despite volume headwinds in certain regions.

Strategic and Operational Outlook

Management highlighted record sales, adjusted EPS, and cash returns in 2025. The company continues to execute its RISE strategy and targets further growth and margin expansion through 2030.

Lincoln Electric operates 71 manufacturing and automation facilities across 20 countries. The company serves customers in more than 160 countries and focuses on welding, cutting, automation, and advanced manufacturing solutions.

Overall, 2025 results show steady top-line expansion, improved profitability, robust free cash flow, disciplined leverage, and consistent capital returns. These metrics position Lincoln Electric well for long-term value creation.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?