Latest Dividend Announcement

Steel Dynamics has raised its quarterly cash dividend to $0.53 per share. The new distribution represents a 6% increase over the prior quarterly rate of $0.50. This marks another step in the company’s long-standing capital return strategy and confirms management’s confidence in recurring cash flow generation.

Details of the Dividend Distribution

The dividend is payable on April 10, 2026, to shareholders of record as of March 31, 2026. The ex-dividend date is March 31, 2026. On an annualized basis, the new payout amounts to $2.12 per share, compared with the previous annual rate of $2.00.

Based on a recent share price of $193.39, the forward dividend yield stands at approximately 1.1%. The indicated payout ratio is about 25%, calculated against forward earnings per share of $15.70. This conservative payout level leaves substantial retained earnings for reinvestment and balance sheet optimization.

Relevant Valuation Metrics

Steel Dynamics commands a market capitalization of roughly $28.5 billion and an enterprise value of approximately $31.2 billion. The forward price-to-earnings ratio is 12.3, while the trailing P/E stands at 24.2 due to cyclical earnings normalization. The forward multiple reflects expectations of earnings recovery and margin stabilization.

The company generates annual revenue of $18.2 billion and EBITDA of about $2.0 billion, resulting in an EBITDA margin near 11%. The enterprise-value-to-EBITDA ratio of 15.4 signals a valuation above historical trough levels but remains moderate relative to growth expectations in domestic steel and aluminum markets.

Revenue growth recently reached 14%, while earnings growth is projected at 35%. Quarterly earnings growth stands at 28%. The balance sheet shows total cash of $0.77 billion against total debt of $4.21 billion. The price-to-book ratio of 3.14 reflects strong returns on invested capital and disciplined asset utilization.

Although free cash flow recently turned slightly negative due to capital expenditures and working capital expansion, operating cash flow remains robust. Management continues to prioritize liquidity and its investment-grade credit rating.

Dividend History and Sustainability

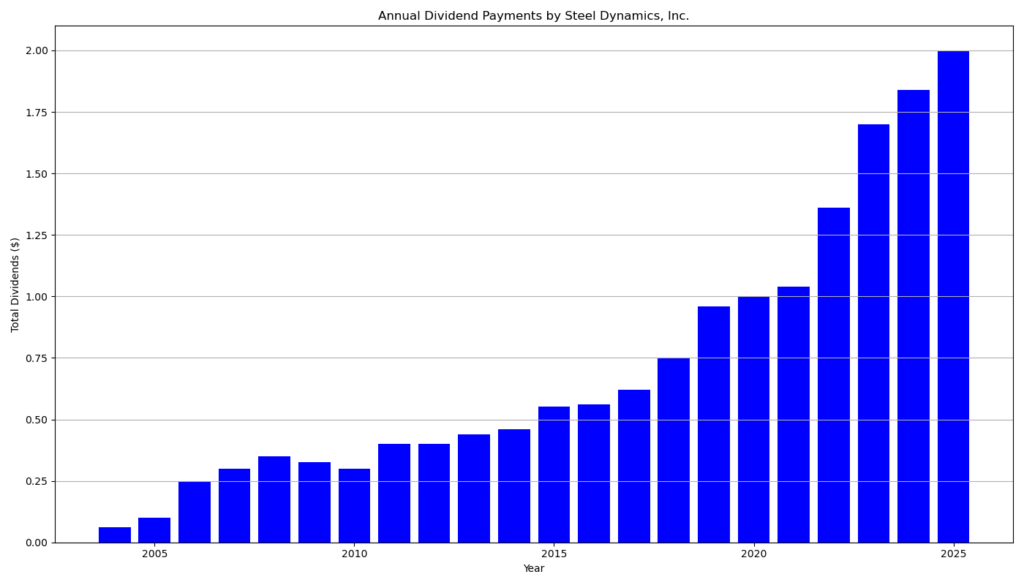

Steel Dynamics has paid dividends for 21 consecutive years and has increased its dividend for 13 consecutive years. The historical record demonstrates steady expansion, particularly since 2013. The quarterly dividend rose from $0.110 in 2013 to $0.340 in 2022, then to $0.425 in 2023, $0.460 in 2024, and $0.500 in 2025. The current increase to $0.53 extends this growth trajectory.

The dividend remained stable during cyclical downturns but resumed increases as earnings strengthened. The modest payout ratio near 25% supports sustainability even in volatile steel markets. The beta of 1.45 reflects cyclical exposure, yet the conservative capital allocation policy mitigates risk for income-focused investors.

Outlook for Long-Term Investors

Steel Dynamics benefits from domestic infrastructure spending, manufacturing reshoring, and trade protection measures. The company continues to expand its aluminum flat-rolled operations and diversify revenue streams. Analysts project continued earnings growth, which should support further dividend increases if cash generation remains stable.

The low payout ratio, consistent earnings growth, and disciplined balance sheet management position the company for sustained dividend expansion. However, investors must consider commodity price volatility and cyclical demand fluctuations.

Company Profile

Steel Dynamics, Inc. operates in the Basic Materials sector within the steel industry. The company runs electric-arc-furnace steel mills, metals recycling operations, downstream steel fabrication facilities, and a growing aluminum platform. It applies a circular manufacturing model that relies heavily on recycled scrap inputs. With nationwide operations and exposure to construction, automotive, energy, and packaging markets, Steel Dynamics ranks among the largest domestic steel producers in North America.

Overall, the latest dividend increase reinforces the company’s commitment to shareholder returns while preserving financial flexibility in a cyclical industry.

last quarterly report*

Steel Dynamics reported solid but lower year-over-year earnings for 2025, alongside record steel shipments and continued capital returns to shareholders .

Fourth Quarter 2025 Results

In the fourth quarter of 2025, the company generated net sales of $4.4 billion, up from $3.9 billion in the prior-year quarter. Net income attributable to Steel Dynamics rose to $266 million, or $1.82 per diluted share, compared to $207 million, or $1.36 per diluted share, in Q4 2024. Sequentially, however, earnings declined from $404 million in Q3 2025 due to lower realized steel pricing and seasonal shipment declines.

Quarterly operating income reached $310 million. The average external steel selling price declined to $1,107 per ton, while average ferrous scrap costs fell to $374 per ton (page 9). The company generated $273 million in operating cash flow during the quarter and returned capital through $73 million in dividends and $240 million in share repurchases.

Full-Year 2025 Performance

For the full year 2025, Steel Dynamics posted net sales of $18.2 billion, up 3.6% from $17.5 billion in 2024. Net income declined to $1.19 billion, or $7.99 per diluted share, compared to $1.54 billion, or $9.84 per diluted share, in 2024. Operating income decreased to $1.48 billion from $1.94 billion in the prior year, primarily due to lower realized steel and fabrication pricing.

Adjusted EBITDA totaled $2.15 billion (page 9), compared to $2.49 billion in 2024. Despite earnings pressure, the company generated strong operating cash flow of $1.45 billion.

Steel shipments reached a record 13.7 million tons in 2025 (page 1 & 9), reflecting improved operating performance and resilient demand in key sectors including construction, automotive, energy, and industrial markets.

Segment Performance

The steel segment remained the primary earnings driver, producing $1.43 billion in operating income for the year. Steel fabrication earnings declined to $407 million from $667 million in 2024. The metals recycling segment improved to $97 million in operating income. The aluminum segment recorded an operating loss of $173 million as commissioning and ramp-up activities continued.

Balance Sheet and Liquidity

Total assets increased to $16.4 billion at year-end 2025 from $14.9 billion in 2024. Cash and equivalents rose to $770 million. Long-term debt increased to $4.18 billion from $2.80 billion, reflecting new note issuance. Total liquidity exceeded $2.2 billion. Total equity stood at $8.79 billion.

Capital Allocation

The company invested $948 million in capital expenditures during 2025, primarily for organic growth projects. It returned significant capital to shareholders through $291 million in dividends and $901 million in share repurchases, representing over 4% of outstanding shares.

Dividends declared per share increased to $2.00 in 2025 from $1.84 in 2024 (page 6), demonstrating continued commitment to shareholder returns.

Outlook

Management expects improving domestic market conditions supported by trade stability, infrastructure investment, and manufacturing onshoring. Steel pricing has improved entering 2026. The aluminum operations in Columbus, Mississippi, continue commissioning, with positive EBITDA achieved in December 2025.

Overall, Steel Dynamics delivered record shipment volumes and strong cash flow in 2025 despite lower pricing pressures. The company maintained financial flexibility, expanded into aluminum, and continued disciplined capital returns while navigating cyclical steel market dynamics .

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?