Latest dividend announcement

The Hartford Insurance Group, Inc. (NYSE: HIG) declared a quarterly dividend of $0.60 per share of common stock. The amount matches the previous quarterly distribution of $0.60 paid in December 2025. The board therefore maintained the current payout level and did not raise the dividend this quarter.

In addition, the company declared a dividend of $375 per share on its Series G preferred stock, equivalent to $0.375 per depository share.

Details of the dividend distribution

The common stock dividend is payable on April 2, 2026, to shareholders of record as of March 2, 2026. The ex-dividend date is March 2, 2026. Based on the current share price of $141.26, the annualized dividend amounts to $2.40 per share and implies a forward dividend yield of approximately 1.7%.

The preferred dividend on Series G shares is payable on May 15, 2026, to shareholders of record as of May 1, 2026. The preferred instrument primarily targets income-focused investors seeking fixed distributions within the capital structure.

Relevant valuation metrics

The Hartford currently carries a market capitalization of roughly $39.4 billion. The stock trades at a forward P/E ratio of 9.7 based on expected earnings per share of $14.49. The trailing P/E stands at 10.6 on trailing EPS of $13.32. These multiples position the stock below the broader market average and reflect the cyclical and capital-intensive nature of the insurance sector.

The payout ratio remains conservative at approximately 16%. This low earnings distribution ratio signals significant headroom for further dividend growth and share repurchases. The company generated EBITDA of about $5.3 billion and reports an enterprise value of roughly $40.0 billion, which results in an EV/EBITDA multiple of 7.5. The price-to-book ratio stands at 2.1 on a book value per share of $67.34.

Revenue reached approximately $28.4 billion, with revenue growth of 6.5%. Earnings growth stands at 37.8%, while quarterly earnings increased by 32.6%. These figures support strong internal capital generation, which underpins dividend sustainability.

Dividend history and sustainability

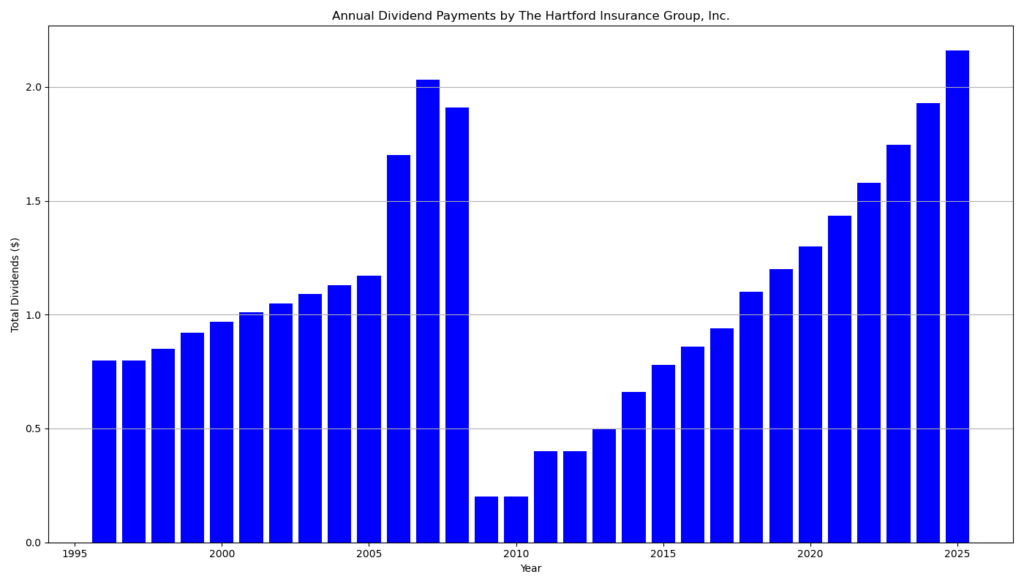

The Hartford has paid uninterrupted dividends for 28 consecutive years and has increased its dividend for 13 consecutive years. The current $0.60 quarterly payout reflects a clear long-term recovery and growth trajectory following the sharp reduction during the 2008–2009 financial crisis, when the dividend temporarily fell to $0.05 per quarter.

In recent years, management demonstrated consistent dividend expansion. The quarterly dividend rose from $0.385 in early 2022 to $0.425 later that year, increased to $0.470 in late 2023, advanced to $0.520 in late 2024, and reached $0.60 in December 2025. The latest declaration confirms that management intends to consolidate this higher base level.

Given the low payout ratio, solid underwriting margins, and disciplined capital management, the current dividend appears well covered by earnings and operating cash flows.

Outlook for long-term investors

The Hartford combines underwriting discipline with stable investment income. The company benefits from diversified operations across property and casualty insurance, employee benefits, and asset management. A beta of 0.60 indicates below-market volatility, which may appeal to defensive investors.

The modest yield of 1.7% does not position the stock as a high-yield vehicle. However, the combination of low valuation multiples, robust earnings growth, and conservative payout metrics creates a favorable total return profile. Long-term dividend investors should focus on dividend growth potential rather than current yield.

A brief company profile

The Hartford Insurance Group, Inc., headquartered in the United States, operates in the diversified insurance segment within the financial services sector. The company provides property and casualty insurance, group benefits, and mutual fund products. With more than 200 years of operating history, The Hartford maintains a strong brand presence and emphasizes underwriting profitability, capital efficiency, and disciplined risk management.

last quarterly report*

The Hartford reported strong financial results for the fourth quarter and full year 2025.

In the fourth quarter of 2025, net income available to common stockholders rose to $1.1 billion, or $3.98 per diluted share, up 33% from $848 million, or $2.88 per share, in the prior-year period . Core earnings also increased 33% to $1.1 billion, or $4.06 per diluted share, compared with $865 million, or $2.94 per share, a year earlier .

For the full year 2025, net income available to common stockholders reached $3.8 billion, or $13.32 per diluted share, up 23% from $3.1 billion, or $10.35 per share, in 2024 . Core earnings for the year increased 25% to $3.8 billion, or $13.42 per diluted share, compared with $3.1 billion, or $10.30 per share, in the prior year .

Return on equity improved meaningfully. Net income ROE for 2025 was 22.0%, up from 19.9% in 2024, while core earnings ROE rose to 19.4% from 16.7% . Book value per diluted share increased 20% year over year to $66.31, and book value per diluted share excluding AOCI rose 13% to $73.62 .

Property & Casualty performance remained strong. In the fourth quarter, Business Insurance generated a combined ratio of 83.6, compared with 87.4 in the prior year, reflecting improved underwriting profitability . Written premiums in Business Insurance grew 7% in the quarter and 8% for the full year . Personal Insurance also improved, with a fourth-quarter combined ratio of 79.6 versus 85.8 in the prior year .

Employee Benefits delivered stable margins, with a fourth-quarter core earnings margin of 7.6% and a full-year core earnings margin of 8.2% .

Investment performance supported results. Fourth-quarter net investment income rose to $832 million from $714 million a year earlier, driven by higher limited partnership income and reinvestment at higher rates . For the full year, net investment income increased to $2.9 billion from $2.6 billion . Total invested assets reached $64.0 billion at year-end 2025 .

Capital management remained robust. The company returned $546 million to stockholders in the fourth quarter, including $400 million in share repurchases and $146 million in common dividends. For the full year, total capital returned reached $2.2 billion, including $592 million in common dividends .

Overall, The Hartford delivered strong underwriting margins, higher investment income, double-digit earnings growth, and improved returns on equity in 2025, while continuing to return substantial capital to shareholders.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?