Latest dividend announcement

Analog Devices, Inc. (ADI) has raised its quarterly cash dividend to $1.10 per share. The new payout represents an 11.1% increase from the previous quarterly dividend of $0.99. This step extends the company’s track record of annual dividend growth to 22 consecutive years. Management emphasizes its long-term capital return framework and commits to returning 100% of free cash flow to shareholders over time through dividends and share repurchases.

Details of the dividend distribution

The increased dividend becomes effective with the payment on March 17, 2026. Shareholders of record as of March 3, 2026 will receive the distribution. The ex-dividend date also falls on March 3, 2026. On an annualized basis, the new quarterly rate of $1.10 implies a forward dividend of $4.40 per share. Based on a recent share price of $349.36, this equates to a forward dividend yield of approximately 1.3%. The prior annualized dividend stood at $3.96, which aligns with the previous quarterly rate of $0.99.

Relevant valuation metrics

Analog Devices currently commands a market capitalization of roughly $171.1 billion. The stock trades at a forward P/E ratio of about 30.4, based on a forward EPS estimate of $11.49. The trailing P/E remains elevated at 76.6 due to lower trailing earnings of $4.56 per share. The price-to-book ratio stands near 5.1, reflecting strong intangible asset value and high margins typical for leading semiconductor franchises. Enterprise value totals about $170.6 billion, translating into an EV/EBITDA multiple of approximately 34.2 and an EV/revenue multiple near 15.5. EBITDA reaches nearly $5.0 billion, with an EBITDA margin above 45%. Free cash flow amounts to about $3.9 billion. The reported payout ratio stands at roughly 85%, which appears high relative to trailing EPS. However, free cash flow coverage provides a more relevant metric for dividend sustainability in capital-intensive semiconductor businesses.

Dividend history and sustainability

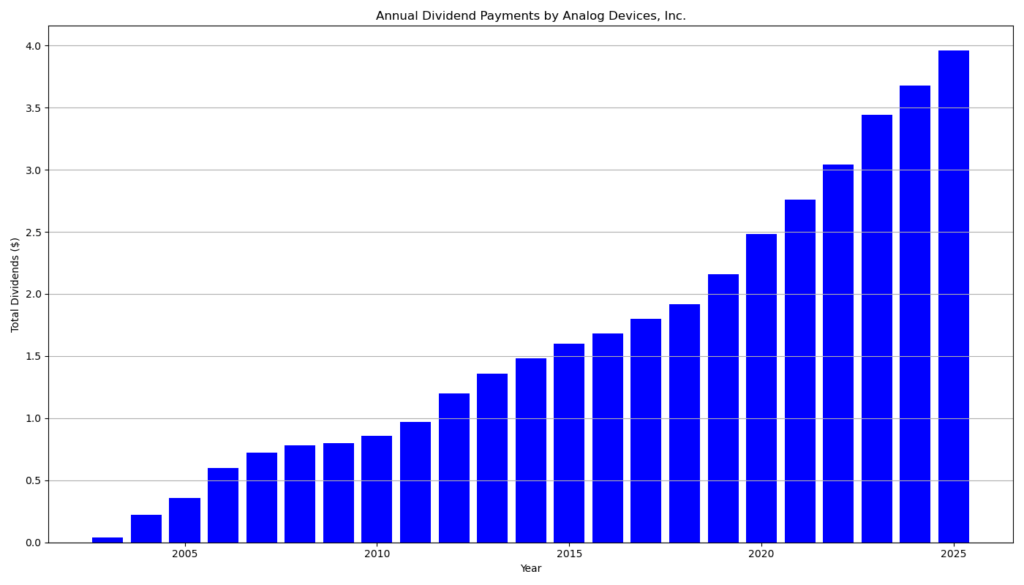

Analog Devices initiated modest quarterly payments of $0.04 in 2003. The company has increased the dividend consistently since then. The quarterly payout rose from $0.30 in 2012 to $0.62 in 2020, then to $0.76 in 2022, $0.86 in 2023, $0.92 in 2024, $0.99 in 2025, and now $1.10 in 2026. This progression demonstrates disciplined capital allocation across multiple semiconductor cycles. The company has delivered 22 consecutive years of dividend growth and 22 uninterrupted years of dividend payments. Management reports 29 consecutive years of positive free cash flow. Since launching its capital return program, Analog Devices has returned more than $32 billion to shareholders. Strong free cash flow generation and resilient operating margins underpin the sustainability of this policy.

Outlook for long-term investors

Revenue growth of approximately 25.9% and earnings growth above 60% signal cyclical recovery and structural demand in industrial, automotive, and data center markets. The beta of 1.03 indicates moderate volatility relative to the broader market. The forward multiple of around 30 suggests that the market prices in sustained earnings expansion. Long-term dividend investors should weigh the moderate yield against high growth potential and consistent capital returns. The combination of dividend growth, share repurchases, and expanding end-market exposure supports a total return thesis rather than a pure high-yield strategy.

A brief company profile

Analog Devices, Inc., headquartered in the United States, operates in the semiconductor industry within the technology sector. The company develops high-performance analog, mixed-signal, and digital signal processing solutions. It serves industrial, automotive, communications, consumer, and data center markets. With annual revenue exceeding $11 billion and strong cash generation, Analog Devices positions itself as a premium franchise at the intersection of hardware, software, and intelligent edge computing.

last quarterly report*

Analog Devices reported a very strong start to fiscal 2026, with broad-based growth and robust cash generation.

Revenue for the first quarter reached $3.16 billion, up 30% year over year from $2.42 billion . Growth was led by Industrial and Communications, with Communications revenue up 63% and Industrial up 38%, as shown in the revenue breakdown table .

Profitability improved significantly. GAAP operating income more than doubled to $997 million, and operating margin expanded to 31.5% from 20.3% . Diluted EPS increased 117% to $1.69. On an adjusted basis, diluted EPS rose 51% to $2.46, reflecting strong operating leverage .

Cash generation remains a key strength. Over the trailing twelve months, operating cash flow totaled about $5.1 billion, or 43% of revenue, and free cash flow reached $4.6 billion, or 39% of revenue . This high free cash flow margin is critical for dividend investors because it supports dividend growth, buybacks, and debt service.

The company returned $1.0 billion to shareholders during the quarter, including $484 million in dividends and $516 million in share repurchases . The board raised the quarterly dividend by 11% to $1.10 per share , marking 22 consecutive years of dividend increases. This consistent growth signals strong capital allocation discipline and confidence in long-term cash flows.

From a balance sheet perspective, Analog Devices ended the quarter with $2.9 billion in cash and equivalents . Total long-term debt stood at about $7.2 billion, with additional short-term debt and commercial paper outstanding . Given annual free cash flow above $4.5 billion, leverage appears manageable, but investors should monitor interest expense and refinancing conditions.

Looking ahead, management guides for second-quarter revenue of approximately $3.5 billion and adjusted EPS of $2.88 at the midpoint . This outlook implies continued margin strength and operating momentum.

For dividend-focused retail investors, the key takeaways are:

- Strong double-digit revenue and EPS growth, which supports future dividend increases.

- High and consistent free cash flow margins near 40%, underpinning payout sustainability.

- A long track record of 22 consecutive years of dividend growth.

- Significant capital returns through both dividends and share repurchases.

In summary, Analog Devices combines cyclical semiconductor exposure with durable cash generation and disciplined capital allocation. If the company maintains revenue growth and free cash flow conversion near current levels, its dividend growth profile remains attractive for long-term income investors.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?