Latest dividend announcement

GATX Corporation has increased its quarterly dividend by 8.2% to $0.66 per share, up from the previous $0.61. The new payout lifts the annualized dividend to $2.64 per share, compared with $2.44 based on the prior rate. At a current share price of $186.65, the forward dividend yield stands at approximately 1.39%, while the trailing yield amounts to about 1.28%.

This step continues the company’s disciplined capital allocation strategy and signals management’s confidence in recurring lease cash flows and earnings visibility.

Details of the dividend distribution

GATX will pay the $0.66 dividend on March 31, 2026. Shareholders of record as of March 2, 2026, will receive the distribution. The stock will trade ex-dividend on March 2.

Based on the new annualized dividend of $2.64 and a forward earnings per share estimate of $10.78, the forward payout ratio stands near 24% to 25%. The trailing payout ratio currently amounts to roughly 28%. These figures indicate a conservative distribution policy and leave substantial retained earnings for fleet investments and deleveraging.

Relevant valuation metrics

GATX operates with a market capitalization of approximately $6.66 billion and an enterprise value of about $15.12 billion. The forward price-to-earnings ratio stands at 17.3, below the trailing P/E of 21.8. This compression reflects expectations of earnings normalization after strong prior-year performance.

The company generated revenue of roughly $1.70 billion over the last twelve months and reported EBITDA of about $0.97 billion, translating into a robust EBITDA margin above 57%. The enterprise value-to-EBITDA multiple of 15.5 positions the stock in the mid-range of capital-intensive leasing peers.

The balance sheet shows total debt of approximately $9.03 billion and total cash of around $0.70 billion. The price-to-book ratio stands at 2.45, based on a book value per share of $76.21. While leverage remains structurally elevated due to the asset-heavy business model, the moderate payout ratio provides flexibility under varying interest rate conditions.

Free cash flow was negative in the latest period due to significant fleet investments. Investors should interpret this in the context of growth-oriented capital expenditures rather than structural cash burn.

Dividend history and sustainability

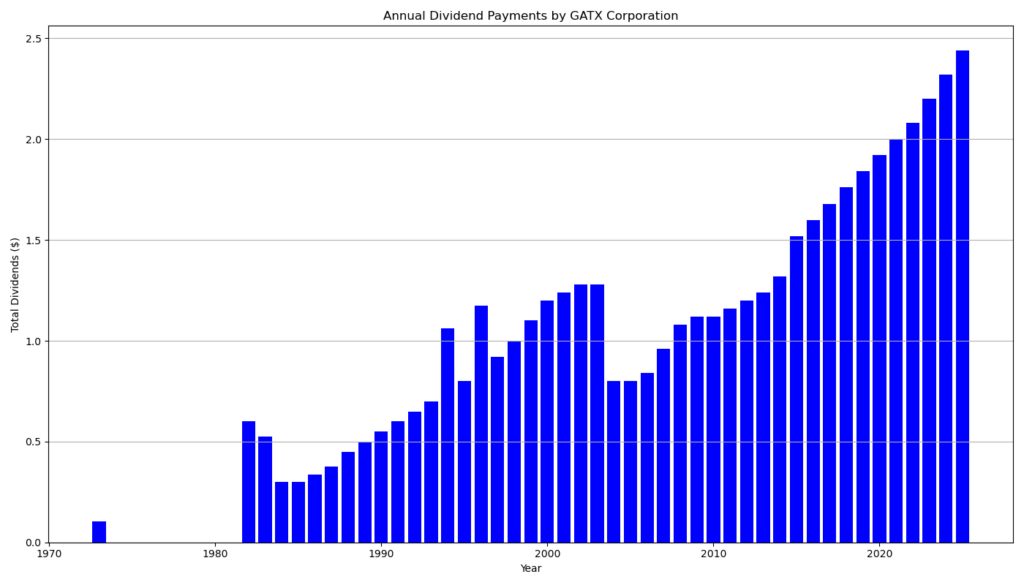

GATX demonstrates a long and differentiated dividend record. The company has paid dividends for 36 consecutive years and has raised its dividend for 15 consecutive years. The latest increase from $0.61 to $0.66 follows a steady progression: $0.58 in 2024, $0.55 in 2023, and $0.52 in 2022.

Over the past decade, the quarterly dividend has grown from $0.33 in 2014 to $0.66 today. This trajectory implies a compound annual growth rate in the high single-digit range. The conservative payout ratio and stable lease revenue base support continued, albeit measured, dividend growth.

Outlook for long-term investors

GATX operates in a cyclical industry. The stock carries a beta of 1.20, which indicates moderate sensitivity to economic cycles. Earnings growth recently softened, with slight declines in year-over-year earnings metrics. However, revenue growth remains positive at over 8%.

Analysts project a median target price of $208, implying moderate upside potential. Combined with a 1.3% to 1.4% yield and mid-single-digit dividend growth, the total return profile appeals to long-term investors who value capital discipline and asset-backed cash flows.

A brief company profile

GATX Corporation, headquartered in the United States and listed on the NYSE under the ticker GATX, operates in the Rental & Leasing Services industry within the Industrials sector. The company leases railcars, aircraft spare engines, and other transportation assets. Its business model centers on long-term leasing contracts, high asset utilization, and disciplined portfolio management. This structure generates recurring revenue streams that underpin its multi-decade dividend track record.

last quarterly report*

GATX Corporation reported strong financial results for the fourth quarter and full year 2025, alongside a dividend increase and a new share repurchase authorization .

For the fourth quarter of 2025, net income reached $97.0 million, or $2.66 per diluted share, up from $76.5 million, or $2.10 per diluted share, in the prior-year quarter. Full-year net income rose to $333.3 million, or $9.12 per diluted share, compared with $284.2 million, or $7.78 per diluted share, in 2024 . Excluding tax adjustments and other items, full-year diluted EPS was $8.75 versus $7.89 in 2024, reflecting solid underlying earnings growth.

Total revenues increased to $1.74 billion in 2025 from $1.59 billion in 2024, driven by higher lease revenue and strong performance in Engine Leasing. Segment profit for the year rose to $688.7 million from $606.0 million, with notable gains in Engine Leasing and Rail International.

Operationally, Rail North America maintained very high fleet utilization at 99.0% at year-end. The Lease Price Index showed a 21.9% average renewal lease rate increase in the fourth quarter, and the renewal success rate improved to 91.4%, supporting stable and growing lease income. Full-year investment volume totaled approximately $1.32 billion, underscoring continued asset growth.

The balance sheet expanded significantly following the acquisition of Wells Fargo’s rail portfolio. Total assets increased to $18.0 billion at year-end 2025 from $12.3 billion in 2024. Recourse debt, net of cash, rose to about $11.95 billion, while total equity increased to $3.64 billion. Recourse leverage stood at 3.3x, broadly in line with the prior year .

The Board approved an 8.2% increase in the quarterly dividend to $0.66 per share, payable March 31, 2026. For full-year 2025, dividends declared totaled $2.44 per share, compared with $2.32 in 2024 . GATX has paid dividends without interruption since 1919. The Board also authorized a new $300 million share repurchase program.

Return on equity attributable to GATX was 12.8% in 2025, compared with 12.1% in 2024. Management initiated 2026 earnings guidance of $9.50 to $10.10 per diluted share, including a modest contribution from the Wells Fargo acquisition.

Overall, GATX delivered higher earnings, strong asset utilization, disciplined capital allocation, and continued dividend growth in 2025, while expanding its asset base through a major acquisition.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?