Latest dividend announcement

Rush Enterprises, Inc. (NASDAQ: RUSHA) declared a quarterly dividend of $0.19 per share. The payout remains in line with the previous distribution. The forward annualized dividend stands at $0.76 per share. Based on a recent share price of $70.01, the forward dividend yield amounts to approximately 1.09%. The company will pay the dividend on March 18, 2026, to shareholders of record as of March 3, 2026. The ex-dividend date is March 3.

Details of the dividend distribution

Rush continues to distribute capital on a quarterly basis. The current $0.19 payment matches the two prior quarterly dividends of $0.19 paid in August and November 2025. In early 2025, the company paid $0.18 per share per quarter. The most recent increase therefore occurred in the third quarter of 2025, when the board raised the dividend from $0.18 to $0.19 per share, representing a 5.6% step-up.

On a trailing basis, Rush paid $0.73 per share over the last twelve months. The indicated forward rate of $0.76 implies modest year-over-year growth. The payout ratio stands at 21.66% of earnings. This low earnings distribution ratio leaves a substantial buffer for reinvestment and cyclical volatility.

Relevant valuation metrics

Rush operates in the auto and truck dealership industry within the consumer cyclical sector. The company currently carries a market capitalization of approximately $5.52 billion. Enterprise value totals about $6.82 billion, which implies an enterprise-value-to-EBITDA multiple of 10.29. With EBITDA of roughly $663 million and EBITDA margins of 8.6%, Rush maintains solid operating profitability for a dealership model.

The stock trades at a forward P/E ratio of 15.8 based on forward earnings per share of $4.43. The trailing P/E stands higher at 20.8 due to recent earnings normalization. Price-to-book equals 2.46 on a book value of $28.45 per share. Revenue for the last fiscal year reached approximately $7.67 billion. Free cash flow totals about $508 million, which comfortably exceeds the annual dividend requirement. Total debt amounts to roughly $1.52 billion, while cash on hand stands near $242 million.

These metrics indicate moderate valuation levels and strong cash coverage of shareholder distributions.

Dividend history and sustainability

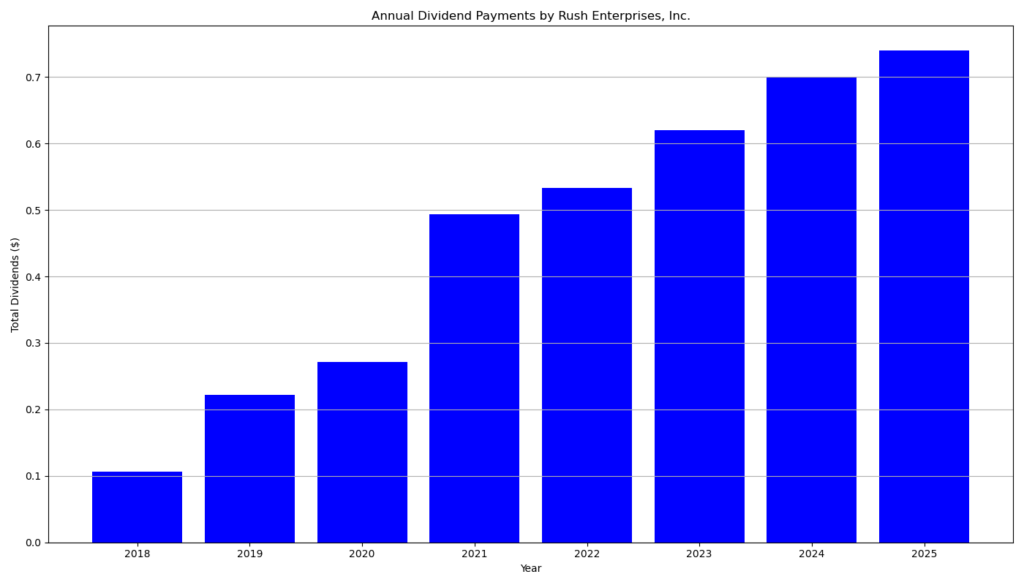

Rush demonstrates a consistent dividend track record. The company has achieved seven consecutive years of dividend growth and seven uninterrupted years of dividend payments. Since 2018, the quarterly dividend has increased from approximately $0.053 per share to the current $0.19 level. The progression reflects a disciplined capital allocation policy rather than aggressive payout expansion.

Earnings growth recently turned negative, with trailing earnings growth at -14.4% and quarterly growth at -15.7%. Revenue growth also declined slightly. However, the low payout ratio and robust free cash flow mitigate short-term earnings volatility. The company’s beta of 0.93 indicates slightly below-market volatility, which supports portfolio stability for income-focused investors.

Given current free cash flow and modest leverage, the dividend appears well covered under normalized industry conditions.

Outlook for long-term investors

Rush operates in a cyclical end market tied to freight demand, fleet replacement cycles, and macroeconomic activity. Earnings may fluctuate with truck sales volumes and financing conditions. However, the business model benefits from recurring revenue streams in parts, service, leasing, and rental operations.

Long-term investors should expect moderate dividend growth rather than high-yield income. The current yield remains below 2%, which limits immediate income appeal. Yet the conservative payout ratio, stable balance sheet, and consistent capital returns support sustainable compounding.

If earnings recover toward forward estimates near $4.43 per share, valuation appears reasonable and dividend growth could continue at a mid-single-digit rate.

A brief company profile

Rush Enterprises, Inc. operates one of the largest networks of commercial vehicle dealerships in North America. The company sells new and used heavy-duty and medium-duty trucks and provides parts, service, leasing, rental, and financing solutions. Its operations generate diversified revenue streams across sales and aftermarket services. This integrated platform positions Rush as a key participant in the U.S. commercial vehicle distribution market.

last quarterly report*

Rush Enterprises reported weaker results in 2025 compared to 2024, reflecting ongoing softness in the commercial vehicle market .

For the full year 2025, revenue declined to $7.4 billion from $7.8 billion in 2024. Net income attributable to Rush Enterprises fell to $263.8 million, or $3.27 per diluted share, compared with $304.2 million, or $3.72 per diluted share, in 2024 . The prior year included a small one-time hurricane-related charge, but even on an adjusted basis, earnings were lower year over year.

Fourth-quarter results followed the same trend. Revenue decreased to $1.8 billion from $2.0 billion, and diluted EPS declined to $0.81 from $0.91 .

Operationally, new and used vehicle sales revenue dropped to $4.5 billion in 2025 from $4.9 billion in 2024, reflecting lower industry demand. However, parts and service revenue remained stable at $2.5 billion, underscoring the resilience of the higher-margin aftermarket segment . Leasing and rental revenue increased 4.1% to $369.6 million, providing additional stability.

Cash flow generation improved significantly. Net cash from operations rose to $848.0 million in 2025, up from $610.0 million in 2024. Free cash flow increased to $448.2 million, and adjusted free cash flow reached $733.4 million, well above the prior year’s $485.4 million . This strong cash generation supported capital returns and balance sheet flexibility.

The company declared a quarterly dividend of $0.19 per share, up from $0.18 in the prior year quarter. Full-year dividends totaled $0.74 per share in 2025 versus $0.70 in 2024 . Total dividends paid during the year rose 5.6% to $58.0 million. In addition, Rush repurchased $193.5 million of stock in 2025 and authorized a new $150 million buyback program .

From a balance sheet perspective, total GAAP debt declined to $1.32 billion from $1.62 billion. On a non-GAAP basis, adjusted total debt was just $3.4 million, and adjusted net cash stood at approximately $209 million . Shareholders’ equity increased to $2.23 billion.

In summary, Rush Enterprises faced cyclical headwinds in truck sales during 2025, resulting in lower revenue and earnings. However, its diversified model—particularly its strong aftermarket and leasing operations—helped stabilize profitability and drive robust cash flow. The company strengthened its balance sheet, increased its dividend, and continued share repurchases, positioning itself well for a potential recovery in commercial vehicle demand in 2026.

*This is the latest quarterly report that the company has filed with the SEC.

Die Selektion dieser Aktie erfolgte zufällig aus einem breiten Spektrum an tagesaktuellen Börsenmitteilungen bezüglich angekündigter Dividendenzahlungen. Der vorliegende Beitrag zielt nicht auf eine qualitative Bewertung dieser dividendenstarken Aktie ab, sondern verfolgt einen rein deskriptiven Ansatz.

Was sind Dividend Champions, Contenders, Challengers?